Happy New Year to everyone, let’s hope it’s a good one.

I start off this post with an excerpt from an article written by Jason Gibbs BAcc., CPA, CA, CFA, Vice President & Portfolio Manager, 1832 Asset Management L.P.

“This is the time of the year when investors feel the need to make short-term forecasts. Save your energy because most of these predictions will turn out to be wrong. The key lesson from 2016 is to never try to time the markets and stop listening to those who profess they can. As Peter Lynch has said: ‘Far more money has been lost by investors trying to anticipate corrections than has been lost in corrections themselves.’

Markets were plummeting in January 2016 and the headlines were grim. Predictably, many took that as a cue to sell, of course at the exact wrong time. One market timing service told their clients to go to 100% cash on January 15. Those who actually followed this advice lost 30%, which is the total return of the TSX since that day. If markets advance in the future by, say, 5% a year on average, that one call may have cost six years of returns.”

It is often difficult to quantify the value that your financial advisor adds to your life. So many small influences on your behaviour contribute to your financial success. The example above, of having an advisor that keeps you staying the course, even when it may be uncomfortable, is profound.

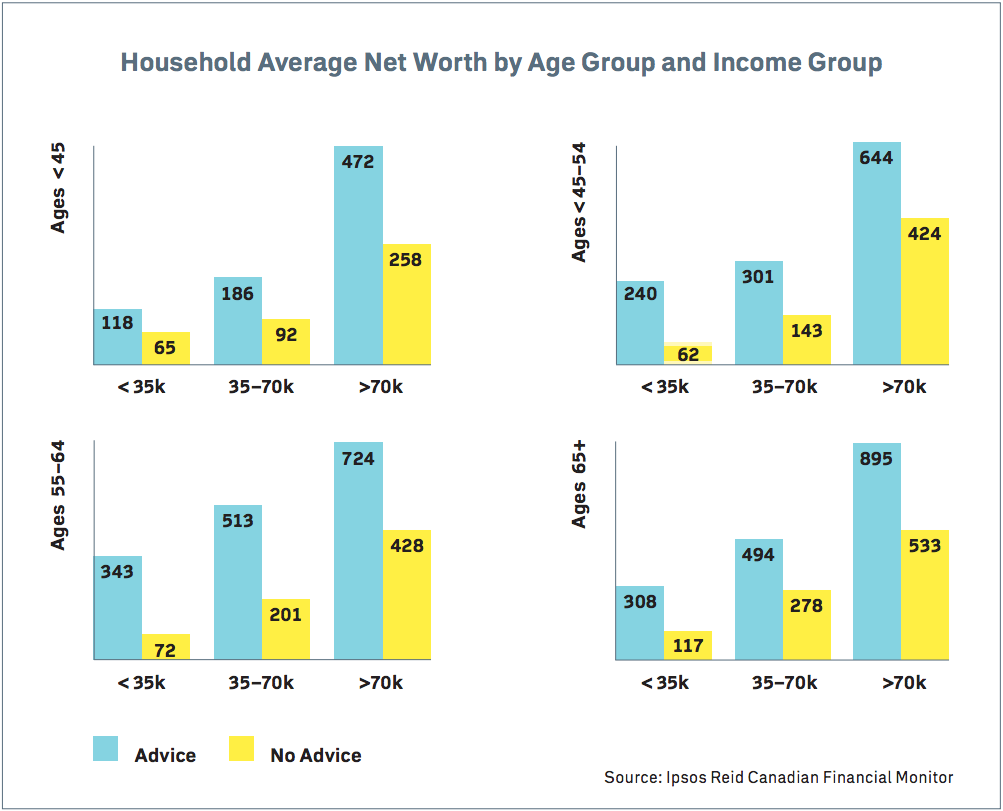

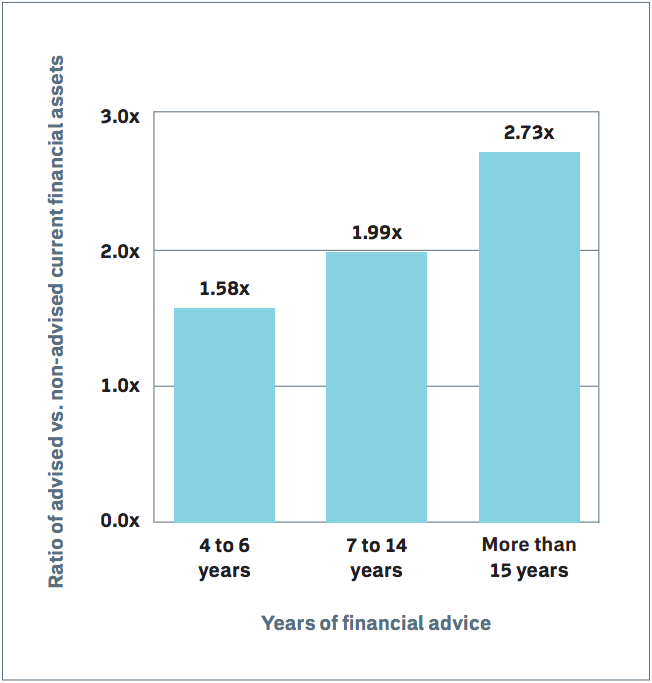

A lot of research has been done in recent years to see how the planning that a financial advisor does, and the support we give, influences the financial success of individuals. The following charts summarize those findings.

If you are interested in reading the entire study and report, here is the link.

The planning we do, you see on a regular basis. The tax planning, estate planning, income and retirement planning have concrete reports and results. The background work you don’t see, such as asset allocation, building and monitoring portfolios, investment research, keeping up with tax law and family law all add to your success. But by far our most important function is help managing your emotional responses to situations that occur which could potentially blow up your financial security.

We take great pride seeing clients who heed our advice, enjoying their lives without worry over their finances. It is truly a gift to know that what we do can be life changing. Thank you to those who continue to share their life journey with us.

-Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any mutual funds managed by 1832 Asset Management L.P. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. Dynamic Funds is a division of 1832 Asset Management L.P.

-Charts with permission from 2012 IFIC Report on the Value of Advice.

I really enjoy reading your articles. Keep up the good work.

And we love writing and sharing them with you! Thanks for your kind words, Mike.