The month of October saw a very strong upswing on the major market indexes. This does not change the fact that 2022 has been an emotional time for investors.

It’s always uncomfortable to live through these kinds of extended market downturns. During these periods of discomfort, it can be helpful to reflect on the past as means to help frame the eventual path forward. Keeping focused on your long-term goals is important during these uncertain times.

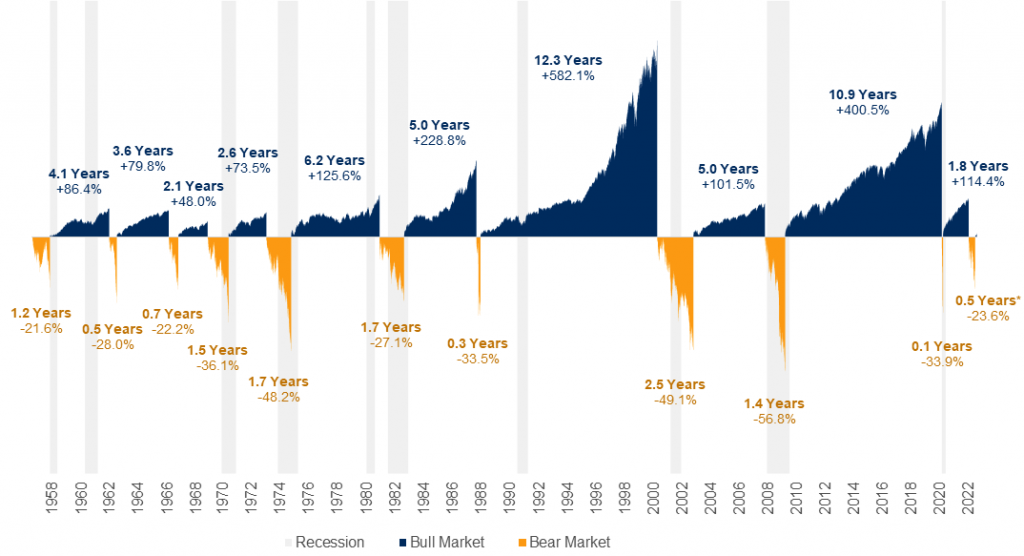

During these kinds of markets, I remind my clients that these are not uncharted waters. Over the past 60+ years, equity markets have seen 10 distinct bear market events. Furthermore, and more importantly to keep in mind, the bull markets have always lasted far longer than the bear markets. You can see from this chart below, the periods of negative market returns are exceedingly shorter than the years of subsequent exponential growth.

So, what does that mean? Is this time any different? The short answer is no. Staying invested (and even adding to your investments during the negative bear markets) is of utmost importance, if you want to be part of the eventual recovery.

Investors tend to want to hide out in safe investments like cash and GICs when the markets are experiencing this kind of volatility, but that can be a mistake, as you may not have liquidity in your safety assets to buy back into the market, and timing this is nearly impossible anyway. Staying invested and riding out these bear markets in the past have proven to be the best strategy for long-term investors.

Still, watching the value of your investments fluctuate is an emotional experience for many people. This is especially true during negative years like 2022 thus far. It’s hurts more when your investments are -10% or -20% and leads to more questions and unease, than it does in the good years when your accounts are up +10 or 20%. While it may not feel like it in the moment, these bear markets are a normal part of the long-term investment cycle. Making dramatic changes to your investment portfolio or strategy may feel more comfortable, but this can have a serious impact on your long-term investment results and get in the way of reaching your goals.

What about a recession? Oh, the dreaded ‘R’ word. While most economists agree it is likely that we will see a recession in 2023, this does not have to impact your investment strategy. The stock markets have predicted many of the past recessions; going down for months before the actual recession arrives. The same markets have also typically begun to recover months before the end of a recession and go on to see 6-8 years of bull markets (read: growth). So, while a recession may drive markets down a little further in the short-term, staying invested and being a part of that potential early recovery in the markets has historically been rewarding for those investors that waited it out.

Thanks you answered all my questions

Very helpful information. I liked the chart.